Introduction

The pharmaceutical market in the Middle East and North Africa (MENA) region has exhibited significant growth over recent years, driven by various socio-economic and healthcare developments. This growth has brought new challenges and opportunities for pharmaceutical market access in MENA, a region diverse in its cultural, linguistic, and economic landscapes. The concerns about the long-term sustainability of oil revenues are driving to shape healthcare markets.

There are different approaches to regulating healthcare sectors in these markets. Several factors impact pharmaceutical market access trends in MENA, including varying market sizes, increasing complexity in securing market access, and the growing importance of private health insurance companies. [1]

To this end, the expansion of private health insurance markets in the Gulf is a significant catalyst for the re-organisation of private sector stakeholders. These shifts in the insurance landscape are reshaping pharmaceutical market access in MENA, particularly in Gulf countries, where price sensitivity and value-based reimbursement are becoming increasingly important factors.

TradeArabia projects that the regional pharmaceutical market in MENA will reach a value of around USD 60 billion by 2025. [2] Historically, from 2018 to 2023, the Middle East region experienced a compound annual growth rate (CAGR) of 4.1%. The forecasted CAGR for 2023 to 2028 is slightly higher at 6.8%. This growth can be attributed to increased healthcare spending, population growth, and government initiatives aimed at improving healthcare infrastructure. [3]

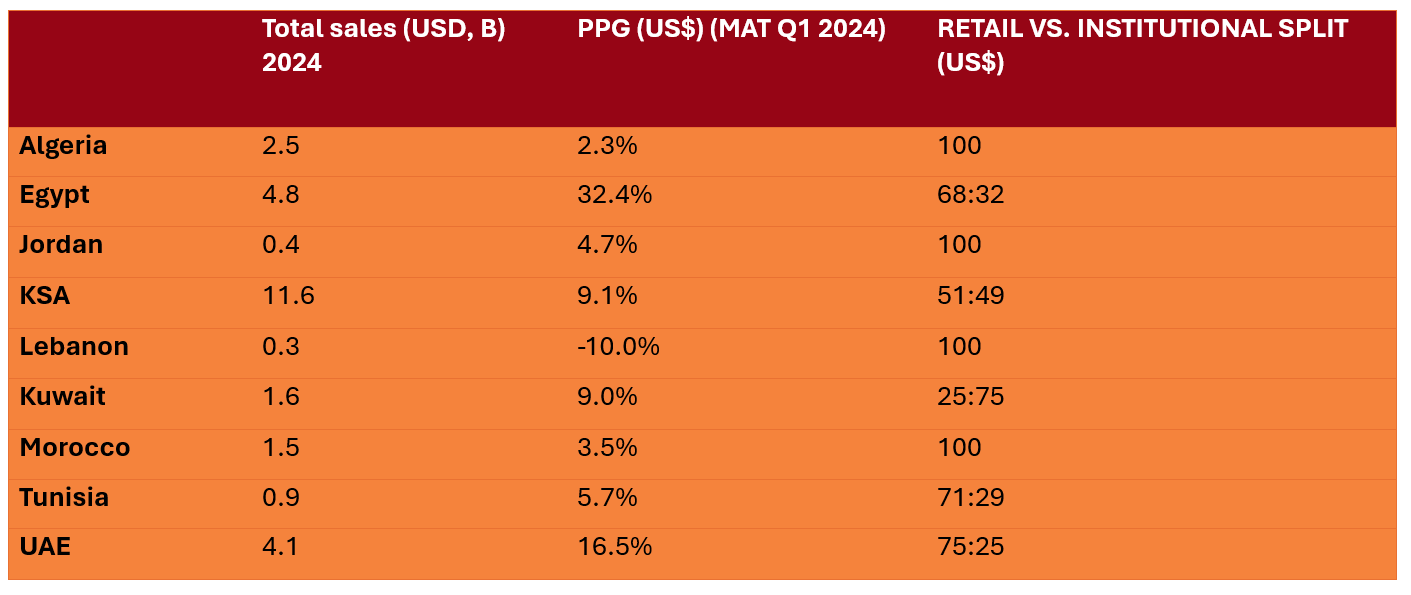

Table 1: Market Statistics and Growth in the Region [3]

*KSA = Kingdom of Saudi Arabia; PPG = Previous period growth; UAE = United Arab Emirates.

The overall Middle East and Africa (MEA) pharmaceutical market has reached a value of $32.6 billion and 8.6 billion units. Retail dominates the market, accounting for 68.5% ($22.3 billion) of value sales and 80.8% (6.9 billion units) of volume. The hospital channel has also seen a growth with an 8.4% increase in value previous period growth (PPG), though it experienced a -2.2% decline in volume PPG.

Multinational corporations (MNCs) hold a commanding 59.4% share of total value sales, growing at 10.8% PPG. The growth is mainly reflected in Egypt (37.2%), UAE (16.7%) and Saudi Arabia (9.9%) PPG. Leading local companies have exhibited varied growth ranging between -7.5% and 11.2%, PPG. Among the top corporations in the MENA region, Sanofi, Novartis, and GSK maintain their dominance, with Eli Lilly emerging as the fastest-growing corporation at an impressive 82% PPG.

Saudi Arabia remains the largest market in the MEA region with a value of $11.6 billion, growing at 9.1% PPG. Egypt has seen a decline by -4.0% PPG, however, still remains the second largest market in the region. The UAE, as the third-largest market, has achieved a value of $4.1 billion, reflecting a substantial growth of 16.5% PPG and a 13.1% CAGR. [3]

Important trends that impact pharma market access in the Middle East and North Africa

Within the changing market access landscape in the MENA region, the following trends impact access to innovations in the next ten years:

- Data for Reimbursement Decision-making;

- The formalised use of Pharmacoeconomics;

- Public-Private Partnerships;

- External Price Referencing (ERP);

- Innovative Contracting;

- Health Technology Assessment (HTA); and

- Artificial Intelligence (AI).

Data for Reimbursement Decision-making

Securing market access in MENA will depend on robust analytics to evaluate the impact of new healthcare technologies in society. This will be crucial to establish a platform to develop pricing insights to discuss with different stakeholders. Such a platform will integrate international perspectives on pricing approaches and support consultative responses to local pricing dynamics in the MENA markets. A well-structured value framework is essential to guide this transition, aligning pricing strategies with clinical value propositions and ensuring that healthcare innovations are both accessible and affordable.

We also need systematised and accurate data to improve decision-making on the costs, resource use, and patient outcomes in private and public health facilities. These variables are inputs for undertaking epidemiological studies, pharmacoeconomic analyses, and budget impact evaluations for new technologies entering the market. Data should integrate patient services in public and private facilities, and inpatient and outpatient treatment settings. Local versus regional care networks are essential for facilitating better budgeting and allocation of funds to reimburse new technologies. [1][4][5]

Figure 1: The Pharma Market Access Landscape in the Middle East and North Africa: The Next Ten Years

Pharmacoeconomics in the Middle East and North Africa

The formalised use of pharmacoeconomics in MENA will enable best available scientific methods to evaluate the economic impact of new technologies. Pharmacoeconomics guidelines will help improve the general understanding of economic evaluation methods, boost stakeholder confidence, and will result in improved decision-making. [5][6]

Applying pharmacoeconomics includes value-based pricing decisions and development of formularies by private health insurance companies. It also involves guiding reimbursement policies set by public payors, including the Ministry of Health, Military Institutions, Hospitals and Specialist Treatment Centres. [7][1]

Most governments revert to decision-making based on the clinical appraisal of a new healthcare technology and its financial impact. A full pharmacoeconomic evaluation of new healthcare technologies is not required, although some countries have encouraged their submission at the time of regulatory approval. [4]

An essential element of this trend is improving skills to strengthen the commercialisation of innovations. Local market access teams rely on pharmacoeconomic and pricing from key regions such as Latin America, North America, Europe, and Asia-Pacific. [7]

The pharmacoeconomic skills improvement involves building stronger capacity among local market access teams and establishing stronger regional presence with competencies across all functional components of market access. There is an urgency to utilise health economic strategies to inform the MENA region decision makers about the value of different technology tailored to each countries’ specific demographic and circumstances. [5]

Public – Private Partnerships and how they shape Pharmaceutical Market Access in MENA

The rise of private sector providers over the last decade marks a significant trend in the Gulf region and one that looks set to evolve further. With population growth and the rise in non-communicable and lifestyle diseases coupled with a growing ageing population, the demand for quality healthcare surged, necessitating the involvement of the private sector to meet this demand. [5]

Countries in the region are increasingly adopting hybrid public-private healthcare models, which offer clear advantages of this cooperation model. The public sector will become the regulator and outsource care delivery to private players, delivering efficient, premium, and sustainable care enabled by technology and digitalisation.

The UAE and Saudi Arabia are at the forefront of the region’s public-private partnership (PPP) trend. In the UAE the demand is growing, especially in rehabilitation clinics, mental healthcare facilities, and dialysis centres. In Saudi Arabia, PPPs have had a similarly positive impact. They continue to see a growing need for more centres, especially in remote areas, which the government is now trying to meet through PPPs. In the past, the government oversaw the building, operation, and maintenance of hospitals, but they have now realised that the private sector has an important role to play, providing upfront investment and delivering healthcare in return. [8]

Future efforts include transparency in these partnerships and how public and private sector stakeholders improve patient outcomes. Reducing duplicative partnerships that result in wasteful expenditure on activities that do not improve the efficiency of healthcare markets is a priority. These public-private partnerships are crucial for accelerating access to innovation and enhancing the overall healthcare landscape in the MENA region, providing a sustainable model for future growth and development.

Figure 2: The Pharma Market Access Landscape in the Middle East and North Africa: The Next Ten Years

External Reference Pricing in the Middle East and North Africa

Across the MENA region pharmaceuticals is heavily influenced by ERP policies as it serves as the predominant mechanism for setting prices of in-patent pharmaceuticals, particularly for new products. Understanding ERP is crucial for pharmaceutical market access in MENA, as it significantly impacts pricing strategies. This, however, represents a significant barrier to sustained higher prices. ERP involves benchmarking the price of a drug against its price in the country of origin, as well as considering prices within the Gulf region

Other decision criteria are also used to influence price setting:

- Factors such as the therapeutic significance of the drug,

- Prices published by government agencies including health technology assessment agencies, and

- Prices of drugs within the same therapeutic category are also taken into account.

The number and range of reference countries differ between countries as does the method of comparing new technologies. Saudi Arabia uses a higher number of reference countries (30 – 40) compared to countries such as Kuwait, but ERP results in increased complexity and increased time-to-market.

Implementing ERP systems is isolated, with very little involvement from market participants. Sometimes, the ERP includes methodological weaknesses. For instance, most countries use the lowest price option in the basket of reference countries and not the mean price, as used in other cases. Therefore, external price referencing systems focus on a price only analysis, irrespective of the country in which it applies. As a result, reimbursement policies are skewed towards the lowest cost option in the therapeutic areas.

Governments seldom consider the value that a new healthcare technology represents for communities and the associated societal benefits. They consider only short-term financial interests. Governments include little in reimbursement policies on the medium-term to long-term value of new healthcare technologies. The key objective of external reference pricing is shifting from a cost minimisation tool to a tool that guides negotiation to affordable prices in the reference countries. [4][9]

Transitioning from External Reference Pricing to Value Based Pricing

External reference pricing should be the first stage in negotiations regarding reimbursement of new products and their inclusion into national benefits formularies. Though countries in MENA have been implementing external reference pricing for several years, it poses significant limitations to early access. This transition is reshaping pharmaceutical market access in MENA, moving towards more sophisticated evaluation methods.

Over the past 15 years, the focus has shifted from ERP to the establishment of robust criteria for value assessment based on clinical and economic evidence. This includes the introduction of HTA, which considers additional criteria beyond costs and effects, capturing the importance of local context and data such as burden of disease, incidence, prevalence, and severity.

The transition to more formalised models of value assessment requires investment in three key areas. First, significant investment is needed in institution-building to establish competent authorities and institutions capable of addressing the challenges of modern value assessment. Second, there must be substantial investment in human capital and the development of capabilities necessary to tackle these challenges. Third, investment in data generation processes is crucial to ensure that decisions are made based on robust and validated evidence. The focus on institutions and human capital determines the roadmap that needs to be followed; evidence from settings that have already progressed to a formal value assessment system suggests that transitioning from one model to another cannot be achieved overnight. However, the long-term benefits for local healthcare systems can be significant, especially in the context of achieving Universal Health Coverage (UHC). [4]

Innovative Contracting, and Pharmaceutical Market Access in MENA

Innovative contracting, particularly through managed entry agreements, is gaining traction in the MENA region as a strategic approach to enhance patient access to costly, innovative therapies while managing healthcare budgets. Innovative contracting is becoming an increasingly important tool for pharmaceutical market access in MENA, especially for high-cost therapies. Despite the inherent challenges in design and implementation, such as limited expertise in health economics, data collection instruments, and the absence of comprehensive patient and disease registries, there is a growing optimism among stakeholders. Innovative contracting remains to be underdeveloped in MENA compared to Europe and North America and stakeholders in the region are aware of the basic forms of innovative contracting. Innovative contracting could be an efficient approach to rewarding innovation by facilitating financial predictability and improving return on research and development.

These managed entry agreements can be broadly categorised into financial-based and outcomes-based agreements. Financial-based agreements focus on cost-sharing mechanisms. These include discounts, rebates, and price-volume agreements. They do not link reimbursement to health outcomes. Outcomes-based agreements, on the other hand, tie reimbursement to the actual performance of the drug in real-world settings. This type includes coverage with evidence development and performance-linked reimbursement.

Financial-based managed entry agreements, such as discounted treatments and price-volume agreements, are currently more prevalent than outcome-based schemes. However, countries like Lebanon and Egypt are beginning to integrate both financial and outcome-based arrangements. The primary therapeutic targets for these agreements include immunomodulators, biological therapies for cancer, and treatments for chronic diseases. [10]

Innovative contracting will grow in importance, given the rise in cancer epidemiology as well as other non-communicable diseases in the MENA region. This, among a high burden of diabetes mellitus, cardiovascular disease, and obesity. Diagnosis improvements and increased life expectancy drive the increase in oncology cases. However, innovative contracts should not be seen as ad hoc solutions to introduce just any high-cost or innovative therapies that come along.

These shared objectives are driving changes in pharmaceutical market access in MENA, fostering more collaborative approaches. Healthcare payers, providers, and manufacturers may each have different objectives, but they do all share a common goal. This is to ensure that patients have timely and affordable access to the most innovative treatments, largely, regardless of their expense.

Innovative contracting should include:

- Valuing the impact of new technologies on diagnosis rates (medical devices);

- Improving public education and awareness around oncology (and other non-communicable diseases); and

- An integrated approach with public and private healthcare sectors.

Many of the market access initiatives in MENA include projects to increase capacity and infrastructure in the healthcare system or simple price discounts, rather than value-based partnerships to improve access to innovative treatments in the region. As well, initiatives targeting pricing and affordability are mostly identified in countries which have relatively limited government funding or public healthcare coverage. [4]

Health Technology Assessment

Currently, HTA is not used in the MENA region; the region still relies heavily on ERP as a cost minimisation tool, by simply benchmarking against the lowest list prices in reference countries. The potential implementation of HTA could significantly transform pharmaceutical market access in MENA, particularly in countries like Egypt and Saudi Arabia. However, MENA regulators have realised that there is a need to transition to a value-based system and there are signs that HTA and value assessment are likely to be implemented in some form in countries such as Egypt and Saudi Arabia, in the years to come. [6]

HTA offers significant advantages in the MENA countries, such as improved care coordination for patients and supporting local decision makers in taking good decisions to keep the healthcare system accessible with the highest quality care. These advantages could greatly enhance pharmaceutical market access in MENA by improving decision-making processes and resource allocation. However, HTA is also associated with considerable limitations, such as a long roadmap, lack of expertise and critical mass, and other broader infrastructure issues. It is important that local decision-makers are very clear about their objectives, such as how HTA fulfils these objectives and how it is linked to other tools currently in operation.

The implementation of HTA in each country may vary depending on the country and the healthcare system in place. Pharmaceutical companies may have more flexibility in private systems compared to public systems where requests for access may arise. Agreement on best practices is important because HTA is increasingly a fundamental part of the way organisations decide on which health technologies they will reimburse. Equally, implementing HTA principles requires a gradual shift in policy-making towards an environment which is more transparent, collaborative, consultative and is supportive of innovation and investment.

Prior to implementing a HTA system, several actions are needed in order to prepare the ground, which include; a) how HTA will be incorporated in their decision-making processes, including the interaction with other policy tools, such as ERP; b) the investment in human and physical infrastructure should be followed by the adoption of HTA and data systems to support its implementation; c) investment in a learning period; d) HTA needs to be separated from the registration process of new innovations, and should not impact registration based on efficacy and safety and e) the principles of HTA should be applied across a wide range of medical interventions, rather than medicines only. [4]

HTA plays a major role in evidence-based decision making and is becoming more widely adopted in regions influenced by market entry of new and cutting-edge technology, especially in the UAE and Saudi Arabia. In terms of engaging stakeholders on pricing and reimbursement, HTA has emerged as a pivotal trend as policymakers in UAE and Qatar are interested in not only the price of the innovative treatment but also the costs avoided with the use these technological advances.

The key to a successful HTA ecosystem in MENA would be contingent on the availability and use of local patient data and will serve as the core to pricing negotiations as well as determining the value of innovative treatments. By following the lead of several European countries and taking a more proactive approach, the MENA region can build a structure based on local data and advocate for a more unified approach for enhancing access to innovation. [11]

Artificial Intelligence

One of the primary advantages AI brings to market access is its capability to enhance data analysis and insights which traditionally was reliant on human expertise. AI is poised to revolutionize pharmaceutical market access in MENA by enhancing data analysis and streamlining regulatory processes. By automating data collection and leveraging machine learning, AI can uncover intricate patterns within vast datasets, treatment costs, and potential market barriers. Moreover, AI’s predictive capabilities can enable companies to simulate various market scenarios, aiding in the development of effective pricing, and value propositions tailored to specific markets and patient demographics.

In the MENA region, AI can also streamline regulatory navigation by automating repetitive tasks and analysing regulatory data. AI can expedite document preparation for HTA and other submissions and identify potential regulatory hurdles. This empowers companies to proactively address regulatory requirements, accelerating the approval process. Pricing and reimbursement strategies also benefit from AI integration. AI can facilitate the development of value-based pricing models by analysing real-world data to determine a drug’s true value proposition based on clinical and economic outcomes. [12]

However, the integration of AI in healthcare, particularly in the MENA region, necessitates robust governance models to ensure ethical and effective deployment. The use of AI in market access comes with ethical, legal, and social challenges that can be navigated through effective and adaptable governance models. Establishing global governance guidelines for the use of AI in these markets are crucial, covering areas such as data management, privacy, ownership, and independent decision-making. This will require the involvement of stakeholders who understand the core principles of ethical AI use and can evaluate the effectiveness of outcomes. Monitoring the use of AI in pharma markets will involve aligning with the recommendations for governance frameworks, ensuring that AI’s impact on healthcare decision-making is both transformative and ethically grounded. [13]

Conclusion

The pharmaceutical market in the MENA region is undergoing a transformative phase, driven by socio-economic changes and evolving healthcare needs. This dynamic landscape presents both challenges and opportunities for stakeholders aiming to secure market access for innovative healthcare technologies.

Several critical trends are shaping the market access landscape in the MENA region. As pharmaceutical market access in MENA continues to evolve, companies must stay abreast of these critical trends to succeed in this dynamic landscape. For companies looking to enter or expand in the MENA region, understanding these trends and adapting to the local context is crucial. The integration of advanced analytics, pharmacoeconomics, and innovative contracting, coupled with strategic public-private partnerships, will be key to navigating this evolving market. The transition towards value-based pricing the adoption of AI and HTA will provide a competitive edge, enabling more efficient and effective market access strategies.

By aligning with these trends and investing in the necessary infrastructure, companies can contribute to the sustainable growth of the healthcare market in the MENA region, ultimately improving patient outcomes and access to innovative treatments.

References

[1] Katoue MG, Cerda AA, García LY, Jakovljevic M. Healthcare system development in the Middle East and North Africa region: Challenges, endeavors and prospective opportunities. Front Public Health. 2022 Dec 22;10:1045739. doi: 10.3389/fpubh.2022.1045739. PMID: 36620278; PMCID: PMC9815436.

[2] Mena pharmaceutical sector to reach $60bn [Internet]. [cited 2024 Jul 22]. Available from: https://tradearabia.com/news/IND_352008.html

[3] 240709_iqvia_mea-pharmaceutical-market-quarterly-report_q1-2024.pdf [Internet]. [cited 2024 Jul 22]. Available from: https://www.iqvia.com/-/media/iqvia/pdfs/mea/240709_iqvia_mea-pharmaceutical-market-quarterly-report_q1-2024.pdf

[4] Kanavos P, Tzouma V, Fontrier AM, Kamphuis B, Parkin GC, Saleh S. Pharmaceutical pricing and reimbursement in the Middle East and North Africa region.

[5] Hamad A, Alsaqa’aby M, Alruthia Y, Aldallal S, Elsisi GH. Overview of Procurement and Reimbursement of Pharmaceuticals in Saudi Arabia, United Arab Emirates, Qatar, and Egypt: Challenges and Opportunities. Glob J Qual Saf Healthc. 2023 Nov 24;6(4):127-136. doi: 10.36401/JQSH-23-1. PMID: 38404458; PMCID: PMC10887475.

[6] Syenza [Internet]. [cited 2024 Jul 26]. Saudi Arabia Economic Evaluation Guidelines. Available from: https://syenza.com/saudi-arabia-economic-evaluation-guidelines/

[7] Pharma Pricing and Reimbursement and Market Access Risk Scores (MARS) by Region – Overview of 2022 and Outlook for 2023 [Internet]. Market Research Reports & Consulting | GlobalData UK Ltd. [cited 2024 Jul 23]. Available from: https://www.globaldata.com/store/report/pharma-pricing-reimbursement-and-market-access-risk-scores-analysis/

[8] PharmaBoardroom [Internet]. [cited 2024 Jul 22]. 5 Pharma Trends to Watch in MEA. Available from: https://pharmaboardroom.com/articles/5-pharma-trends-to-watch-in-mea/

[9] Carapinha JL. Comment on the implications of external price referencing of pharmaceuticals in Middle East countries. Expert Rev Pharmacoecon Outcomes Res. 2016;16(1):11-4. doi: 10.1586/14737167.2016.1136791. Epub 2016 Feb 2. PMID: 26707161.

[10] Maskineh C, Nasser SC. Managed Entry Agreements for Pharmaceutical Products in Middle East and North African Countries: Payer and Manufacturer Experience and Outlook. Value Health Reg Issues. 2018 Sep;16:33-38. doi: 10.1016/j.vhri.2018.04.003. Epub 2018 Jun 22. Erratum in: Value Health Reg Issues. 2020 Dec;23:148-149. doi: 10.1016/j.vhri.2020.11.001. PMID: 29936067.

[11] PharmaBoardroom [Internet]. [cited 2024 Jul 23]. HTA in the Middle East & Africa: Differentiated Approaches. Available from: https://pharmaboardroom.com/articles/hta-in-the-middle-east-africa-differentiated-approaches/

[12] Healthcare M. Marksman Healthcare. 2024 [cited 2024 Jul 24]. Transforming Pharma Market Access: The Rise of Artificial Intelligence. Available from: https://marksmanhealthcare.com/2024/03/19/transforming-pharma-market-access-the-rise-of-artificial-intelligence/

[13] Carapinha JL, Botes D, Carapinha R. Balancing innovation and ethics in AI governance for health technology assessment. J Med Econ. 2024 Jan-Dec;27(1):754-757. doi: 10.1080/13696998.2024.2352821. Epub 2024 May 13. PMID: 38711204.

Table of Contents