Introduction

The South African National Health Insurance Impact on Pharma and MedTech Market Access is a critical topic to explore as the country undergoes significant changes in its healthcare landscape. With the introduction of the National Health Insurance (NHI) system, an integrated healthcare system based on solidarity and redistribution principles is emerging. In this article, we delve into the potential consequences of the NHI system for the Pharma and MedTech industries and how it may influence patients’ access to innovative pharmaceuticals and medical devices in South Africa.

Patient access to innovations from a Pharma and MedTech market access perspective

How will the national health insurance system impact a patient’s access to innovations from a Pharma and MedTech market access perspective? The question is so fundamental because pharmaceuticals and medical devices are one of the most important interventions to reduce mortality and morbidity in healthcare systems. Access to innovations has over the decades been a major driver in reducing the burden of disease and prolonging life. How likely will new healthcare technologies be bought for the national health insurance system?

An indicator may help us predict the ability of the South African government to increase pharmaceutical and medical device market access. The Global Competitiveness Report 2018 by the World Economic Forum measured the “future orientation of government” in 140 countries and South Africa ranked 102.

There were four questions in this category:

- How fast is the legal framework of your country in adapting to digital business models (e.g., e-commerce, sharing economy, fintech, etc.)?

- To what extent does the government ensure a stable policy environment for doing business?

- To what extent does the government respond effectively to change (e.g., technological changes, societal and demographic trends, security, and economic challenges)?

- To what extent does the government have a long-term vision in place?

The questions are unrelated to pharmaceutical or medical device market access under a South African national health insurance system. However, they provide an important clue on how the government will consider innovative technologies, the policy framework and its flexibility, and the extent the government can think ahead.

South Africa’s low ranking on the Global Competitiveness Report suggests an uncertain future for government funding of new healthcare technologies. It ranked slightly better than Haiti and Zimbabwe but worse than Mali and Burkina Faso. As a result, patients covered by the national health insurance system are unlikely to benefit from new medicines and medical devices available in the private and international market.

Figure 1: Pharma & MedTech Market Access under a South African National Health Insurance system

South African National Health Insurance Impact on Pharma and MedTech Market Access

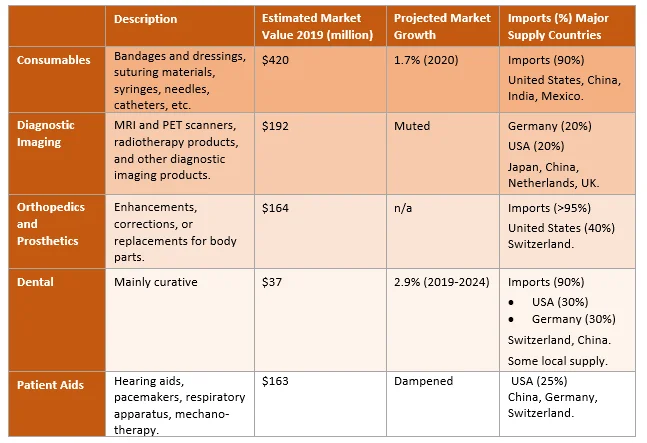

Medical Devices

Current growth in the medical device market remains subdued due to the economic recession, which the COVID-19 pandemic has exacerbated. Planned upgrades of public health facilities and systems as part of their NHI implementation program may catalyze some growth in this sector. However, the recent significant budgetary shortfalls and the pandemic fallout will negatively impact government spending. Private sector investment will also continue, albeit at a cautious pace, as many increasingly are coming under considerable cost pressures.

Table 1: NHI Impact on Medical Devices

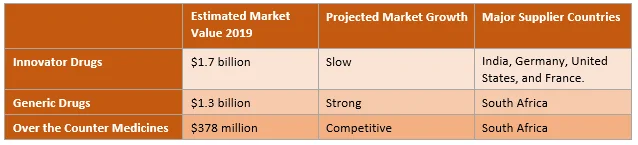

Pharmaceuticals

The implementation of the National Health Insurance plan may see a rising demand for prescription generic drugs, improved healthcare infrastructure and access, as well as increased local pharmaceutical production of generics. Demand and spend as it relates to high value medicines, will be tempered, or entirely impeded by the economic recession, and COVID-19 pandemic. The treatment of HIV/AIDS and TB remains a focus, but over the long-term, effort will also shift towards rising chronic disease burden, such as diabetes, cardiovascular disease, hypertension, and cancer treatments.

Table 2: NHI Impact of Pharmaceutical Market

The advantages and disadvantages of a South African national health insurance system

The success of NHI depends on the final national health insurance model and how national health insurance will work in practical terms. It also depends on how national health insurance policy will impact the health needs of a very diverse patient population.

For instance, national health insurance for senior citizens, for families, for government employees, and regulating national health insurance for foreigners. It also depends on the ability of pharma market access staff and their companies to address the advantages and disadvantages of a South African national health insurance system.

We’ve compiled a list of the advantages and disadvantages related to national health insurance. The list is not exhaustive, there’s a lot more that we could add, but the purpose is to encourage a balanced and critical approach.

The advantages of a South African national health insurance system

- Financial risk protection. No person should be rendered poor because of unexpected healthcare expenditure.

- Reduction in out-of-pocket payments. To access healthcare services many South Africans must pay at the point of service.

- Improved affordability and access to health care services. With national health insurance, healthcare services outside of the reach of the poor and vulnerable members of the community, will now be within reach.

- Earlier healthcare interventions: patients that delayed seeking healthcare services may now act earlier.

- Sustainable care: patients with chronic conditions are less likely to interrupt medicine consumption or healthcare services due to financial constraints.

- Improved social cohesion: national health insurance covers all members of society, including the rich and the poor, the young and the old, women and men, and employed and unemployed.

- Risk pooling: by including everyone under the national health insurance system, it spread the risk of adverse health events across a large group of people.

- Improved benefit transparency: a well-designed and communicated benefits package may improve the transparency of entitlements for everyone covered under the national health insurance system.

- Improve the quality of life. Through access to essential health care services and financial risk protection, the overall quality of life of those covered by the national health insurance system will improve.

The disadvantages of a South African national health insurance system

- NHI depends on a strong economy: South Africa’s slow economic growth and increasing emerging-market financial risk reduce the amount of resources available for the national health insurance system.

- Inefficiencies in state-run agencies. The poor track record of state-run agencies in managing public resources, such as Eskom and SAA, may provide a glimpse into future obstacles faced by a national health insurance system.

- NHI requires investments in equipment and infrastructure: the quality of South Africa’s public healthcare infrastructure is weak as evidenced by the Office of Health Standards Compliance.

- Human resources for NHI. Evidence suggests there are insufficient healthcare workers in the public sector to manage the future demand. Providers in the private healthcare system will hesitate to join the national health insurance system.

- NHI depends on strong service delivery. Poor service delivery by government-run hospitals results in significant harm to patients. This is evidenced severe harm caused to patients in Gauteng’s hospitals and growing medico-legal expenses at all levels of the healthcare delivery system.

- Strong governance facilitates NHI. The poor management of access and funding for trastuzumab (indicated for HER2-positive breast cancer patients) in the public sector, may be the canary in the coal mine. In demonstrates how the national health insurance system may enable access to new healthcare services and technologies.

- Improvements in quality-of-care boost the success of NHI. South Africa’s public health care system has not implemented meaningful processes that lead to improvements in quality of care, eroding the confidence in a national health insurance system.

- Transparent and strategic purchasing strengthen the NHI system. South Africa faces serious corruption problems as evidenced by the Transparency International Corruption Perceptions Index. It suggests that the national health insurance system will encounter bribery, nepotism, tender entrepreneurship, and inappropriate use of public resources for private purposes.

Figure 2: Pharma Market Access under a South African National Health Insurance system

Current challenges for market access under National Health Insurance

Achievement of universal healthcare through the NHI was intended for implementation by 2025. However, several challenges are hindering the process. The National Planning Commission has stated that full implementation of the scheme could take up to 25 years.

Some challenges for implementation include:

- Suppression of Innovation: Innovation and R&D are core to pharmaceutical manufacturing businesses. However, the draft NHI bill imposes more limitations on innovation and innovative medicine.

- Medicine Pricing: A centralized function to facilitate and coordinate procurement of medicine, with risk sharing and engagement between government and suppliers is proposed, and it is anticipated to impose on innovation.

- Sustainable Financing: Financing should be based on sound and realistic costing. However, considering the economic forecasts, NHI funding is likely to be unsustainable in the absence of sustained economic growth.

- Decreased supply: The state, as the dominant purchaser of healthcare services may impact the supply of those goods. The pressure on pharmaceutical suppliers of generic medicines under increased pricing pressure, may lead to a highly concentrated market with fewer options available under the NHI. Suppliers who are unable to manufacture because of restrictions may exit the market, with the net result that certain brands, including essentials medicines may no longer be available locally. There is also a great financial risk to suppliers whose tenders were not successful and who may not be able to wait for the next round of tenders. Supply security would be compromised, leading to significant stock-outs as suppliers choose not to increase production during this time. These are already a concern and may be compounded by potential foreign investment declining, as multinationals withdraw from the market. The compounding effect could result in outbreak of disease, due to inadequate supply of medicines.

- Public sector procurement process: Current challenges in the public sector, include non-payment of suppliers, poor supplier performance, unhealthy supplier relationships, lack of management of supplier contracts after the tender is awarded, and lengthy buyout processes are common themes with the procurement process, which in turn compound the stock-out and shortages of essential medicines.

- Public Private Partnerships (PPPs): Manufacturers will have to strategically affiliate themselves with the NHI fund and consider forming PPPs to supply medicines at negotiated prices. It is intended that private sector skills and experience be harnessed in the establishment of PPPs to empower the state sector to include elements such as client education, medicine compliance and self-care, and setting up registries as part of health outcomes research initiatives.

Pharmaceutical Pricing under National Health Insurance

The implementation of the SEP regulation initially had a positive impact on the price of originator and generic medicine pricing in South Africa. However, the increase of medical scheme fees, along with an increase in food and non-alcoholic beverage prices, has significantly contributed to the rise in the consumer price index (CPI). In February 2020, Stats SA measured the cost of medical schemes and fees charged by private sector medical practitioners and hospitals, and found that these costs, plus the costs of medicines contributed to overall consumer and medical inflation.

The SEP regulatory system does have issues, as higher logistics fees from manufacturers may incentivize wholesalers and distributors to stock their brands and thereby push those products down the value chain. A better logistics fee structure has a direct lever in creating a preference for certain medicine brands being stocked and distributed in the market. It is a strategic area of negotiation between manufacturers, wholesalers, and distributors; and a percentage of the SEP that varies between 7.4% and 12.5% (avg. 6%). The SEP should not impact the integrity of the supply chain, and there is room for improvements in the system for better pricing regulation.

The state tender system is being negatively affected by the failure of suppliers to bid due to lack of supply of raw materials and active pharmaceutical ingredients (APIs). This forces the state into direct buyouts from pharmaceutical companies, and at times, having to pay the SEP. This makes it difficult to determine the net effect on total pharmaceutical expenditure. It is likely that some prices currently paid by the state will not be attainable under the NHI.

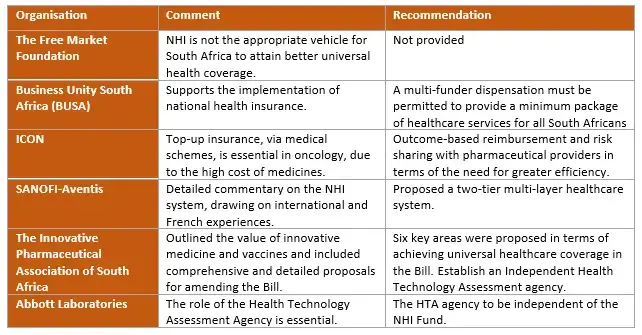

Six organizations and their public positions on NHI

Table 3: Six Organizations and their public positions on NHI.

We analyze the South African National Health Insurance Impact on Pharma and MedTech Market Access.

Solidarity and redistribution of healthcare resources under a South African national health insurance system is an important objective. However, so is a patient’s access to innovations and reducing morbidity and mortality.

The future of government funding new healthcare technologies is uncertain. Patients covered by the national health insurance system are unlikely to benefit from new medicines and medical devices available in the private and international market.

We analyze the impact on Pharma and MedTech market access of national health insurance systems, among other changing health policies.

Bibliography

International Trade Administration. South Africa Country Commercial Guide. Healthcare: Medical Devices and Pharmaceuticals. 2021. Available at:https://www.trade.gov/country-commercial-guides/south-africa-healthcare-medical-devices-and-pharmaceuticals. Accessed 28 September 2022.

Deloitte. Enabling Innovation in the NHI. 2021. Available at: https://www2.deloitte.com/content/dam/Deloitte/za/Documents/life-sciences-health-care/za-GS-Enabling-Innovation-in-the-NHI-Conversation-Summary.pdf. Accessed on: 28 September 2022.

Mashile D. National Health Insurance: Its impact on Pharmaceutical Pricing and the Operational Costs of Drug Manufacturers. 2020. Inclusive Society Institute: Cape Town. Available from: https://www.inclusivesociety.org.za/post/nhi-its-impact-on-pharmaceutical-pricing-and-the-operational-costs-of-drug-manufacturers Accessed on 28th September 2022.

Parliamentary Monitoring Group. National Health Insurance (NHI) Bill: public hearings day 10. 2021. Available at: https://pmg.org.za/page/National%20Health%20Insurance%20(NHI)%20Bill:%20public%20hearings%20day%2010. Accessed on 28 September 2022.

Table of Contents