What is value-based pricing of new healthcare technologies?

Value-based pricing aims to reward pharmaceutical companies and medical device companies for investments in new healthcare technologies that result in sustained improvements in patient quality of life. We also expect such technologies to deliver measurable net economic benefits for society.

In economic theory, value-based pricing is when a buyer’s willingness to pay for a product (or service) matches what the buyer pays. For example, a buyer that is willing to purchase a mug of coffee for $3.50 purchases it for $3.50. It means the price of the mug of coffee matches the buyer’s valuation of the mug of coffee.

A buyer’s willingness to pay depends on income levels (affordability) but it also depends on the perceived value of the product (service) and whether the buyer can estimate its value. In this article, we’re interested in the latter – better approaches to estimate the value of new healthcare technologies.

We have more data generated through scientific methods in healthcare markets to facilitate a value-based pricing approach than, for instance, the dominance of perceived value in mobile phone markets. Value-based pricing works if it adheres to rigorous standards and is independent of institutional conflict of interest.

Figure 1: Value-Based Pricing of New Healthcare Technologies

Why is value-based pricing important in healthcare systems?

Health insurance companies and governments use financial and administrative barriers to manage the use of new technologies. Cost-sharing (coinsurance or copayments), prior authorization, clinical panel reviews, therapeutic reference pricing, and new technology appraisals manage the incremental uptake of new technologies.

New healthcare technologies are funded through employer and employee premium contributions or financed through government tenders or national health insurance systems. Patients can sometimes access new technologies when all other treatment options have proven unsuccessful. This depends on the strength of the health financing system and the price of the new healthcare technology.

High prices incentivize the research and development of new healthcare technologies. However, the list prices of some new technologies are unaffordable for health financing systems undergoing rapid change.

For example, the Department of Health in Abu Dhabi introduced a reference reimbursement pricing system and mandated the dispensing of generic medicines for patients with health insurance. In South Africa, the National Department of Health plans introducing a national health insurance system that will remodel the health financing system.

A value-based pricing approach determines the value status of a new healthcare technology. If the current list price is an overvaluation of the new healthcare technology, then the price should decrease, or if undervalued then the price should increase. Value-based pricing is a critical price-finding mechanism in healthcare markets.

Two Principles in Value-based Pricing

The improvement of population health should be quantified and also measured nationally. One of the metrics used is ‘quality-adjusted life years’ (QALYs), which estimates the years of full health gained from an intervention. However, QALYs, when used alone are biased against disabled life years, though they can be used as a starting point for a deeper analysis.

Policy makers can factor in the following two ethical principles of value-based pricing to promote population health with an optimal and equitable approach.

- Societal Priorities in Value Assessment: A publicly available maximum price that incorporates opportunity costs and inequities needs to be derived. This is critical for payers who need to make coverage determinations that best reflect societal preferences while managing budgets. The spend on high-priced drugs may also require increased insurance premiums or adapting the cover. When looking at public programs, trade-offs beyond the health care system can be considered.

- Value-based Access: Value-based pricing must include a commitment to value-based access. Treatments priced according to their population-level impact should meet the standard for payers’ social mandate for coverage. In these cases, prior authorization requirements and high coinsurance (copay), should be limited, enabling patients and physicians to make treatment choices that reflect their preferences. Negotiations between payers and manufacturers should include offering value-based access as an incentive for value-based pricing. This way, widening the access for treatments priced according to value, allows payers to communicate to innovators which health improvements are most needed and well rewarded.

Distinguishing frequently used terms conflated under Value-based Pricing

The term value-based pricing has been redefined beyond its original meaning. Nowadays, it generally constitutes shorthand for any changes to the traditional payment models for drugs.

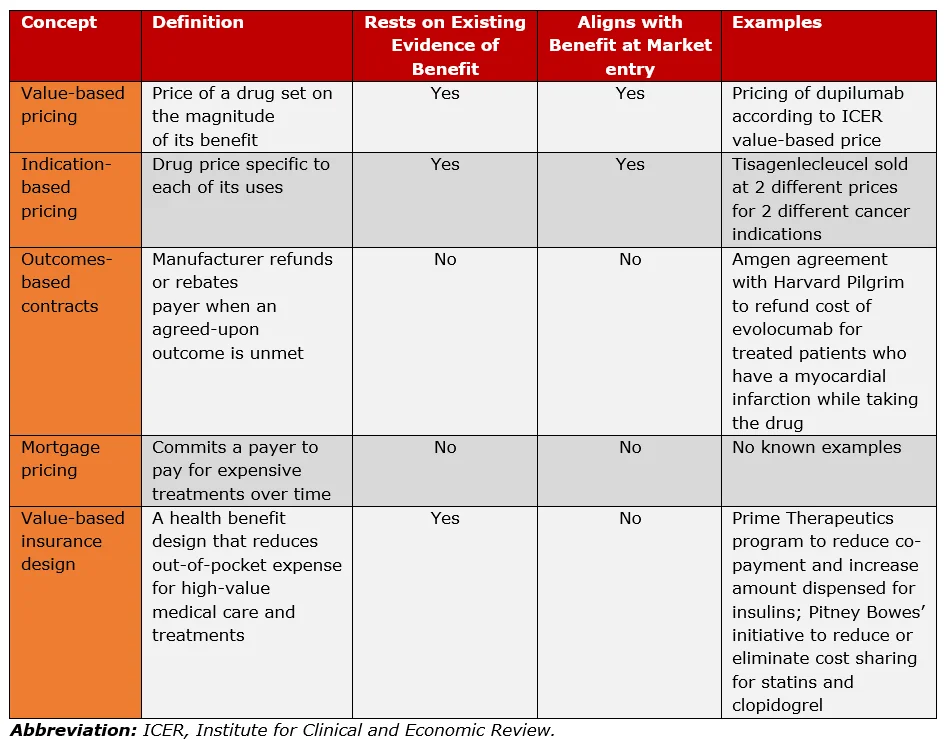

Despite sharing terminology, these concepts vary widely in their capacity to align the price of a drug, with its capacity to improve health outcomes. A taxonomy for differentiating amongst the approaches frequently conflated under the term value-based pricing are described below, with a summary and examples provided in Table 1.

- Value-based Pricing: is premised on the notion that rewards for innovation should be based on the extent of its benefits. The value-based price is set at market entry, is transparent and replicable, open to public input and allows for price adjustments, based on post-approval evidence.

- Indication-based Pricing: prices the same drug differently, based on the indication in which it is being used. It proposes that one drug can have higher and lower prices, when the benefits in the indications differ. Indication-based pricing is not stand-alone. It is a subpart of value-based pricing, where the drug’s price is linked to its benefits.

- Outcome-based Contracting: is based on the notion, that if a drug fails to achieve its therapeutic effect on a specific patient, the cost of the drug is then refunded. Outcomes based contracting premises that if a drug does not help a patient, it should not cost anything; however, this approach draws attention away from what the price should be when it reaches its intended effect.

- Mortgage Pricing: spreads the price of an extremely high-priced drug over a number of years but does not address the high price. Mortgage pricing is endorsed in that some treatments provide benefits long after they have been received, so therefore paying for the drug over a longer period of time is reasonable.

- Value-based Insurance Design: proposes that drugs with large health benefits should have lower out-of-pocket costs irrespective of their prices. As lower out-of-pocket costs are generally associated with higher rates of medication use, value-based insurance design indirectly targets the reward mechanism for innovation by driving sales volume of drugs that are more effective.

Table 1: Comparison of Value-Based Pricing and Adjacent Concepts (Source: Kaltenboeck, et.al.: 2018)

Operational Steps for Value-Based Pricing

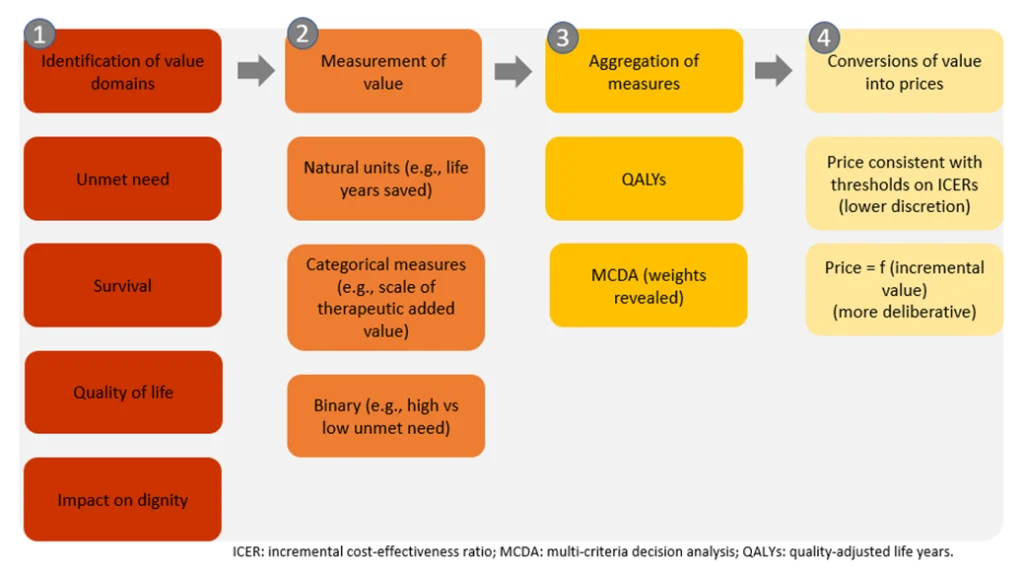

From an operational viewpoint, a well-defined value framework for value-based pricing should be systematically adopted.

This value framework (Figure 2) requires, that as a first step, the relevant components of value/benefits are 1) identified, 2) measured and 3) aggregated. With the next step, 4) the aggregate value should be converted into a price through various models. The conversion method will depend on the drivers identified in the value framework. If cost-effectiveness is the driver, then the price is calculated using the incremental cost-effectiveness ratio and the relevant willingness-to-pay (WTP) threshold, or the net monetary benefit. Otherwise, a premium price over the active comparator is identified in proportion to the additional value.

Figure 2: Operational steps for value-based pricing (Source: Jommi, et.al., 2020)

Complex Scenarios: Medicines with Multiple Indications and/or Combinations

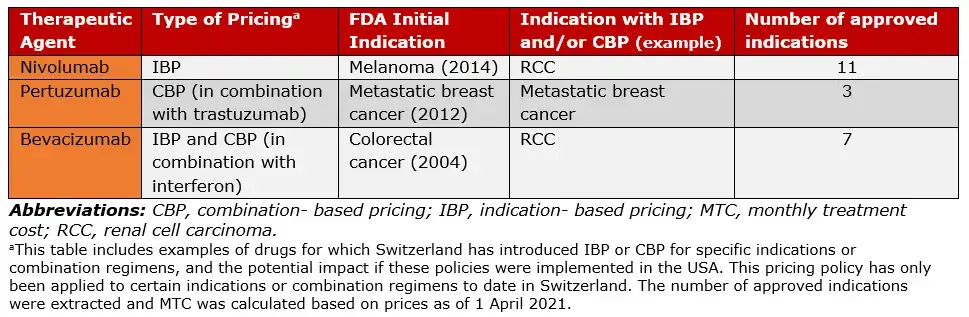

Reforms to reduce the high cost of brand-name drugs (which are much higher in USA than other 1st world countries) are under discussion by legislators in the USA. One of the solutions is to actively negotiate prices, and potentially make those prices available to the private sector as well. Should the USA decide to implement a form of value-based pricing, drugs that have been approved for multiple indications and those approved as part of a combination regimen present two complex scenarios.

The prevalence of both these scenarios has increased in the past few years, particularly in Oncology. For example, nivolumab, pembrolizumab and bevacizumab, which are all approved by the FDA are registered for 9, 11 and 7 indications, respectively.

As well, often supplemental indications and combination therapies are often linked. In another example, pembrolizumab, initially approved by the FDA for the treatment of melanoma (2014), has since been granted supplemental approvals as a single agent for multiple cancers, as well as in combination regimens.

Furthermore, the range of approved indications per new active agent, as monotherapy or in combination is expected to increase, presenting important challenges when negotiating the prices of drugs with multiple indications or administered in combination regimens. These challenges include, whether 1) drugs with multiple indications should be reimbursed at a single price level when the degree of therapeutic value might vary among indications; and 2) whether combination therapies should be reimbursed at the sum of the prices of the different drugs they include (even though the therapeutic value might not be additive in the same way).

Table 2: Selected anticancer agents approved for multiple indications or in combination regimens (Adapted from Vokinger, et.al., 2022)

Understanding value-based pricing and the WHO’s “serious reservations”

The first World Health Organization Fair Pricing Forum met to discuss improvements to medicine pricing practices. They established the Forum to:

- Facilitate the exchange of insights on fairer medicine pricing systems,

- Identification of research gaps to support improvements, and

- Explore the intended and unintended results of the current pricing system.

Press coverage on the first Forum included remarks by World Health Organization assistant director-general, explored further below. They were: “So-called value-based pricing has become a mantra for much of the industry, but Kieny said she had “serious reservations” about a system that essentially puts a value on a life and then allows a drug to be priced up to that level.”

However, the assistant DG’s comments appear to conflict with recommendations made by the same organisation. The World Health Organization project on Choosing Interventions that are Cost-Effective (WHO-CHOICE) recommends that willingness to pay thresholds be based on national income per person (Gross Domestic Product per Capita). That is, it links the willingness to pay for a healthcare technology to the average economic productivity of a person in a country.

For example, the average annual GDP per person in Kenya is USD 1,710.50 (2018), meaning each person contributes this amount in economic value to the economy. It includes children, the poor and the most productive in the “per capita” calculation. Under health technology assessment guidelines, for equity purposes, all people in a country are treated fairly and impartially.

The WHO-CHOICE project recommends that a technology is cost-effective if the cost per DALY avoided is less than three times the annual GDP per capita. World Health Organization Member States (those in low and middle-income countries) use the WHO-CHOICE recommendation to guide pharmaceutical policies on new healthcare technologies.

Returning to the Kenya example above, the World Health Organization recommended willingness to pay threshold in Kenya would be USD 5131.50. They consider a new medicine at a cost per DALY less than this threshold as cost-effective. The World Health Organization approach puts a value on a life. It recommends that a medicine is good value for money when the cost per DALY avoided is lower than three times the average annual income level of a person in a country.

A medicine priced to capture the full productivity of a person leaves no surplus income for the economy. For example, a medicine priced at USD 1,710.50 per annum in Kenya is equal to a person’s GDP. This leaves no surplus income for other economic activities, e.g.: infrastructure investments, education subsidies, etc. Many pharmaceutical markets (and national economies) are unlikely to sustain “full pricing” of new health technologies if they extract the entire economic productivity of a person.

Although standard economic theory links value-based pricing to the willingness to pay of a buyer, evidence to inform such pricing strategies are often challenging to generate. Differences in disease areas, market structure, and national income levels would make a single, globally applicable value-based price approach indefensible. Such differences may lead to differential pricing strategies responsive to varying GDP per capita levels, an approach already pursued by some global pharmaceutical companies.

Two models to make valued-based pricing work

In reviewing the literature and the previously presented operational value-based framework, two distinct models, a) direct and b) indirect, multi-attribute models emerge on how value-based pricing is implemented.

- Direct Models: Here, cost-effectiveness is a driver. The value of a drug is clearly based on cost-effectiveness thresholds for additional QALYs. The UK uses this direct model.

- Indirect, multi-attribute models: In this model, cost-effectiveness is not a driver, and it is more difficult to identify evidence of actual implementation of value-based pricing. Here, there needs to be, 1) a clear, predefined link between added value and the premium price, 2) transparency in the way added value is measured and converted to a premium price. Countries who depend on this model, may find it difficult to determine whether pricing is driven by value-for-money or sustainability (budget). The USA is an example of an indirect, multi-attribute model where prices are not regulated, and value-based pricing is applied differently.

Our work in this area links value-based pricing to the cost-effectiveness ratio. It also addresses the limitations of the WHO-CHOICE approach of thresholds based on GDP per capita, and medicine pricing mechanisms based solely on willingness to pay. The aim is to strengthen pharmaceutical markets by delivering value for money in new healthcare technologies and rewarding market participants.

Bibliography

- Evans DB, Edejer TTT, Adam T, Lim SS. Methods to assess the costs and health effects of interventions for improving health in developing countries. BMJ. 2005;331(7525):1137-1140. doi:10.1136/bmj.331.7525.1137

- Murray CJ, Evans DB, Acharya A, Baltussen RM. Development of WHO guidelines on generalized cost-effectiveness analysis. Health Econ. 2000;9(3):235-251. doi:10.1002/(sici)1099-1050(200004)9:3<235:aid-hec502>3.0.co;2-o

- Ortegón M, Lim S, Chisholm D, Mendis S. Cost effectiveness of strategies to combat cardiovascular disease, diabetes, and tobacco use in sub-Saharan Africa and South-East Asia: mathematical modelling study. BMJ. 2012;344:e607. doi:10.1136/bmj.e607

- Kaltenboeck A, Calsyn M, Frederix GWJ, et al. Grounding Value-Based Drug Pricing in Population Health. Clin Pharmacol Ther. 2020;107(6):1290-1292. doi:10.1002/ cpt.1741

- Jommi C, Armeni P, Costa F, Bertolani A, Otto M. Implementation of Value-based Pricing for Medicines. Clin Ther. 2020;42(1):15-24. doi:10.1016/j.clinthera. 2019.11.006

- Vokinger KN, Kesselheim AS. Value-based pricing of drugs with multiple indications or in combinations – lessons from Europe. Nat Rev Clin Oncol. 2022;19(1):1-2. doi:10.1038/s41571-021-00561-6

- World Health Organization. Fair Pricing Forum: Informal Advisory Group Meeting, WHO Headquarters, Geneva, 22-24 November 2016. World Health Organization; 2017. Accessed March 3, 2022. https://apps.who.int/iris/handle/10665/334341

- Abu Dhabi patients to have wider access to generic drugs. The National. Published January 8, 2018. Accessed March 3, 2022. https://www.thenationalnews.com/uae/abu-dhabi-patients-to-have-wider-access-to-generic-drugs-1.755916

- National Health Insurance | South African Government. Accessed March 3, 2022. https://www.gov.za/about-government/government-programmes/national-health-insurance-0

- WHO wants transparency, market revamp for fairer drug pricing. Accessed March 3, 2022. https://www.geo.tv/latest/141464-WHO-wants-transparency-market-revamp-for-fairer-drug-pricing

Table of Contents